The cryptocurrency market has experienced significant developments in recent months, with notable price movements and evolving regulatory landscapes. This blog post provides an in-depth analysis of these trends, compares recent and future projections, and offers insights into the anticipated trajectory of the crypto market.

Recent Market Developments

In late 2024, Bitcoin achieved a significant milestone by surpassing the $100,000 mark for the first time. This achievement was largely attributed to the election of President Donald Trump, who has expressed strong support for cryptocurrencies. His administration’s commitment to establishing the U.S. as the “crypto capital of the planet” and plans to create a strategic Bitcoin reserve have further bolstered market confidence.

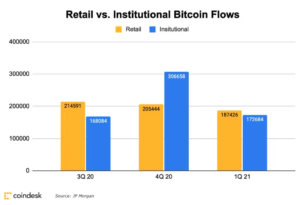

The approval and subsequent launch of Bitcoin Exchange-Traded Funds (ETFs) in early 2024 played a pivotal role in this rally. These ETFs provided institutional investors with a regulated avenue to gain exposure to Bitcoin, leading to increased demand and contributing to the price surge.

Market Analysis and Future Projections

Analysts maintain an optimistic outlook for Bitcoin and the broader cryptocurrency market as we progress through 2025. Projections suggest that Bitcoin could reach valuations between $180,000 and $200,000 by the end of the year. This growth is expected to be driven by factors such as limited supply, growing institutional demand, and the anticipated effects of Bitcoin’s four-year halving cycle.

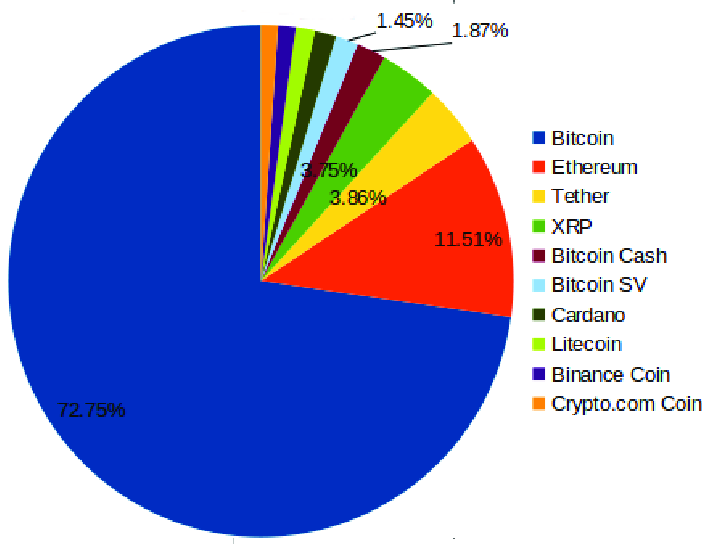

Ethereum, the second-largest cryptocurrency by market capitalization, is also expected to experience significant growth. Predictions indicate that Ethereum could trade above $6,000, with some estimates suggesting it may approach $10,000. This growth is anticipated to be fueled by the increasing adoption of decentralized finance (DeFi) applications and the expansion of smart contract functionalities.

Altcoins, including Solana (SOL) and Sui (SUI), are projected to experience substantial appreciation, with SOL potentially exceeding $500 and SUI surpassing $10. However, it’s important to note that altcoins may face sharper declines during market corrections, with potential drops of up to 60% during consolidation phases.

Regulatory Landscape and Institutional Adoption

The current administration’s favorable stance towards cryptocurrencies is expected to lead to the implementation of crypto-friendly regulations. This regulatory clarity is anticipated to boost confidence and adoption among both retail and institutional investors. Additionally, there is growing optimism regarding the approval of ETFs for other cryptocurrencies, such as Solana and XRP, which could further enhance market liquidity and accessibility.

nstitutional adoption is on the rise, with traditional financial institutions increasing their involvement in crypto markets. Notably, companies like BlackRock and Goldman Sachs have expanded their crypto-related services, signaling a shift in attitudes towards digital assets. This trend is expected to continue, with more institutions integrating cryptocurrencies into their portfolios and service offerings.

Technological Innovations and Emerging Trends

The convergence of artificial intelligence (AI) and blockchain technology is poised to drive innovation within the crypto space. AI-driven decentralized finance (DeFi) protocols are expected to transform on-chain trading, with multiple AI-driven protocols potentially exceeding $1 billion in market capitalization.

The tokenization of real-world assets (RWA) is another emerging trend, with the potential to revolutionize traditional finance by enabling fractional ownership and enhancing liquidity. This development is anticipated to gain significant traction, supported by favorable economic policies and advocacy from major financial institutions.